For full Hartford Courant coverage and related content, please click here.

Sometime during her 20-year career in financial services, and later as founder and CEO of her own startup, Sheryl O’Connor resigned herself to being the only woman in every room.

But in Hartford, at least, O’Connor has found herself feeling less and less out of place as a female entrepreneur, something reflected in a new analysis of the city’s startup ecosystem, released last week by the nonprofit Kauffman Foundation and research firm Startup Genome.

Her company, year-old WealthConductor LLC, is among the 35 percent of Hartford-based startups with at least one female founder, according to the report, which looked at the entrepreneurial community of six small-to-midsize U.S. cities. Globally, women comprise about 16 percent of startup founders, a share that’s remained stagnant since 2012, according to California-based Startup Genome.

“It’s definitely a really positive sign,” O’Connor said of the Hartford finding. “There are a lot of well-educated women in Connecticut who have the gumption to get out there and start their own firm.”

Candace Freedenberg, another Hartford entrepreneur, says she sees the evidence every day in her own clients — mothers trying to re-enter the workplace.

Through her company, Untapped Potential, Freedenberg has placed nearly 50 women in highly skilled positions, securing them trials called “flex returns” that often lead to full-time jobs.

A handful of women in her pool of candidates plan to start their own businesses down the road; and two venture capitalists in her network are eager to train women to join their teams.

And throughout Greater Hartford, she’s seen greater representation at business panel discussions, conferences and accelerator programs, with women increasingly pitching ideas, mentoring startups and looking for investments and partners.

It feels like an improvement over 2015, when she first pitched Untapped Potential to a largely male audience. “When you go to those things, two years later, there’s more equity in the room,” Freedenberg says.

Among the six cities, Springfield, Mass., had the highest density of young, tech-based startups.

Hartford isn’t alone. Among the six cities analyzed, Springfield had the highest density of young, tech-based startups, and the largest share of female-founded startups — 40 percent.

Kauffman Foundation and Startup Genome chose its six startup ecosystems — Alburquerque, N.M., Reno, Nev., New Orleans and Fresno, Calif. — to be representative of cities across the country. They’re each smaller than the 40 largest U.S. metro areas, and have had slower economies than the nation as a whole.

In Hartford, the study noted, a “focus on leveraging regional expertise in insurance” appears to have helped the startup scene explode. Locally, city and corporate leaders are also working to energize the fields of financial technology and medical technology and digital health.

O’Connor, a former employee of Mass Mutual and The Hartford, is part of that push at WealthConductor, located at 100 Constitution Plaza. The income program she developed with co-founder Philip Lubinski has 130 subscribers, up from 50 when the company launched last year.

She’s also raised $400,000 from three angel investors, and is planning to raise another $1 million to keep building up WealthConductor’s software and team of financial planners.

But O’Connor knows her success is not representative of female founders, in Hartford or otherwise.

Women business owners receive half as much as their male counterparts in early stage capital, even as they deliver higher revenue, according to a June study by the Boston Consulting Group and MassChallenge, a Boston-based network of startup accelerator programs.

If the data’s out there, why aren’t they “investing in women-owned companies? — Sheryl O’Connor

The study looked at 350 companies and determined that the 92 founded by women received an average of $935,000 in investments, compared with $2.12 million invested in the male-founded startups.

Meanwhile, the women-founded businesses generated 10 percent more revenue over five years — an average of $735,000 compared with the men’s $662,000.

The results shocked O’Connor, who was especially taken aback that women-founded startups generated 47 cents more per dollar invested than their male counterparts.

“If you’re successful as a woman entrepreneur, you’ve had to work exponentially harder at it than a man,” she said. “You’d think from an investor standpoint, they’d just go by dollars and cents, and [ask], ‘What’s my return on investment?’ ”

“If the data’s out there, why aren’t they investing in women-owned companies?” she asked.

BCG and MassChallenge found a few themes that contributed to the wide investment gap.

Women founders consistently got more push back from investors during their presentations, including more questions designed to test their knowledge of the basics.

Women were less likely to challenge investors who disagreed with their ideas. They offered more conservative projections, and sometimes asked for less money than men.

And they often pitched ideas targeted at women, like businesses around beauty or child care, meaning the male investors were less familiar with their products and services.

That’s where O’Connor sees the most potential for change: getting women-founded startups adequately funded with venture capital.

Ali Lazowski decided to skip pitching to investors altogether when she sought funding for Bare Life, her startup producing allergen-free foods and recipes for people like her, suffering from chronic illnesses that cause dietary restrictions.

The West Hartford native turned to crowdfunding to raise money for the launch of her first product, a hot chocolate mix that’s organic, non-GMO, kosher and free of dairy, gluten, refined sugar, yeast, egg yolk and xantham gum.

The approach had its drawbacks — she raised only $9,500, far short of the $55,000 she’d planned on to launch her company with a 2,000-unit production run of hot chocolate and the release of two cookbooks.

But Lazowski, who began retail sales this month, says she lacked confidence at the start of her journey, a more common pitfall among women entrepreneurs than men. And it went beyond the physical ailments that inspired her to launch the brand, including irritable bowel syndrome, Hashimoto’s disease, thyroid cancer and Lyme disease.

“I felt like I was sort of fragile in what I was doing,” she said. “I didn’t think I could be in business, like, ‘Me, are you sure?’ I still struggle with it, the insecurity.”

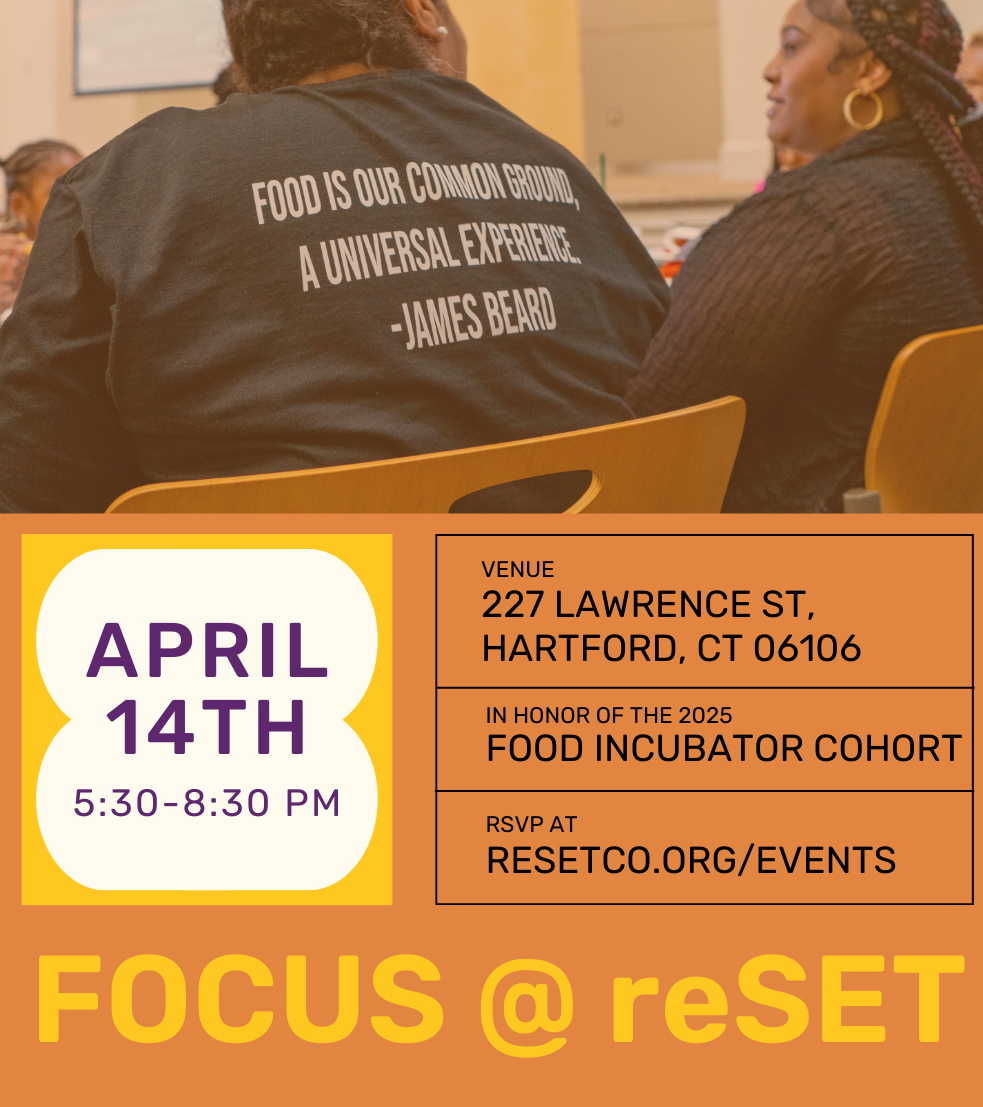

She worked through those doubts as a member of reSET, a Hartford-based nonprofit that supports social enterprises.

And raising money online paid off in other ways, helping Lazowski reach a wide audience and build a test market. Many of her 60 backers also are potential customers. O’Connor and Freedenberg agree, though, that connecting women to venture capital will help close the gender gap.

I still struggle with it, the insecurity. — Ali Lazowski

It’s already begun, according to a 2017 study by the University of Pennsylvania and Harvard University, which surveyed more than 1,600 accredited angel investors across the country.

Women made up 30 percent of those who started investing in the past two years, compared with 22 percent of angel investors overall.

The survey also found signs that women investors consciously tried to invest in other women — half of female respondents said they consider the gender of a business founder when deciding whether to invest, compared to 6 percent of men.In time, Freedenberg thinks, more women will see the benefits of investing, how it takes all the same skills as a traditional corporate job, but doesn’t confine you to a traditional office.

“It’s flexible work,” she says. “It’s something you can be thinking of all the time and put your all into, but do it on your own schedule.”