For full Hartford Business Journal coverage and related content, please click here.

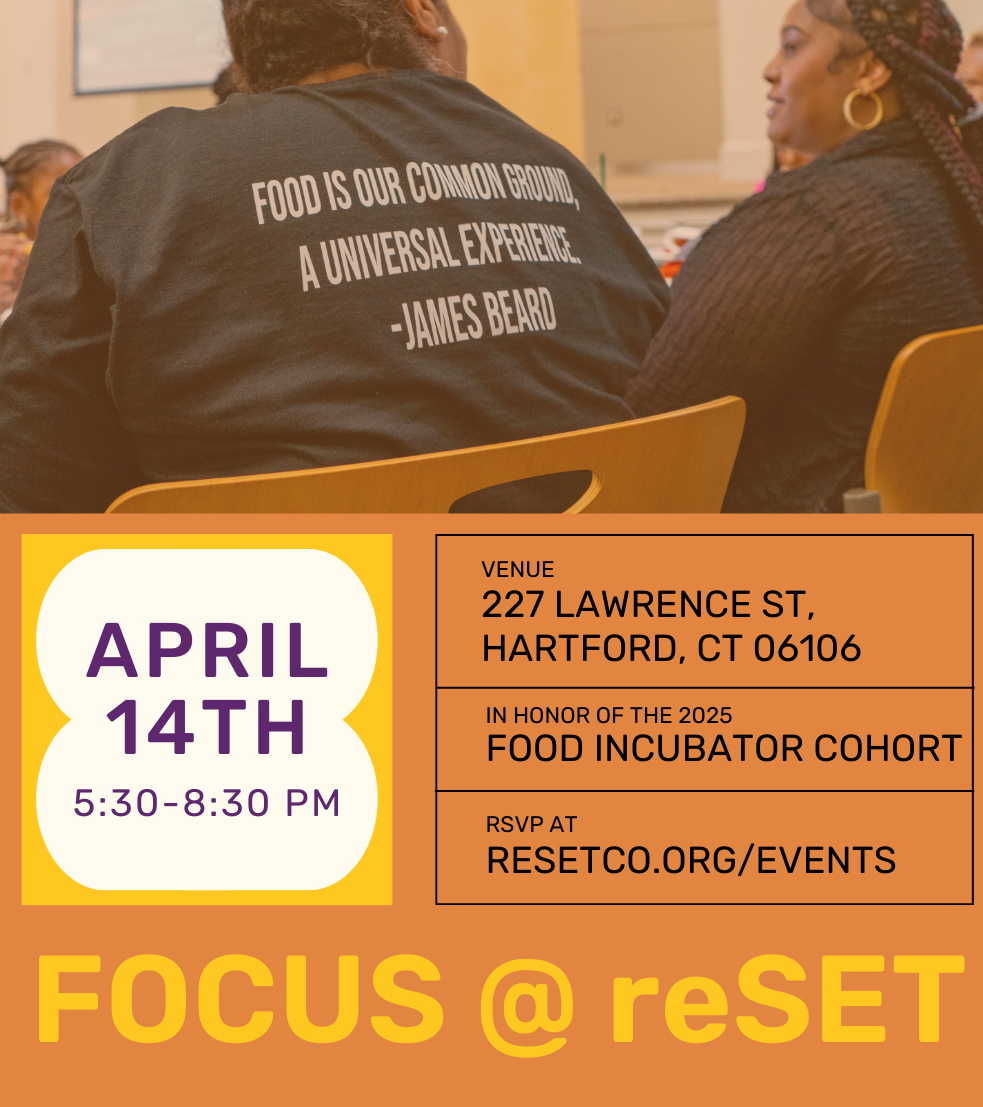

Project Ray CEO Boaz Zilberman, whose startup makes smartphones and apps accessible to the visually impaired, and David O’Leary, a Springfield angel investor, talk at reSET’s recent 2018 Venture Showcase at Dunkin’ Donuts Park.

More investors need to open their checkbooks to help Hartford-area and other Connecticut startups advance if the state wants to grow its entrepreneurial ecosystem, startup proponents say.

“Investors that care about the state … have to step up and say, ‘If I don’t invest locally, then there won’t be startups and if there’s no startups, there’s no ecosystem and if there’s no ecosystem, the city is stuck,” said Shana Schlossberg, founder and CEO of Upward Hartford, the sprawling coworking, incubator and accelerator space that opened last year inside downtown Hartford’s Stilts building.

Schlossberg said Hartford and the state overall need a much more serious angel investor network to pitch wealthy business executives to contribute annually to build the funding network. For example, a first-level investor might be asked to give $25,000 to $100,000 per year, which “should cover almost every executive we know,” she said. A second level might include $100,000 to $500,000.

The investment need is a sentiment shared by Ojala Naeem, managing director of Hartford’s reSET, another organization that works to grow startups with mentoring programs and has an annual accelerator.

“You’re seeing activity pick up, but we have a long way to go,” Naeem said. “Especially on the angel investor community, if we don’t get that off the ground, it’s going to be tough — that’s why companies leave.

“That could mean losing a company and innovations hatched in Connecticut to places like Boston or New York, where many large, active angel networks thrive and can wave money carrots in return for relocation, she said.

The funding issue, including later-stage venture capital (VC), is pronounced in a state known for its wealth, sources say.

Connecticut ranks far behind Massachusetts and New York in terms of venture capital investment. Massachusetts investments were 31 times greater than Connecticut’s in 2017 and New York’s were 50 times greater. Rhode Island had almost as much invested in VC-backed startups as Connecticut last year, $190.3 million vs. $223 million, according to a PwC/CB Insights MoneyTree report.

Lack of investors and the challenge of raising money is the region’s biggest “pain point” that Schlossberg said she and Naeem have identified.

That challenge is not lost on Matthew McCooe, CEO of Connecticut Innovations (CI), the state’s quasi-public agency that invests in state-based startups. It has about 165 companies in its portfolio.

He acknowledged there are far more startups emerging from the entrepreneurial pipeline than funders available to advance them to the next stage.

“It’s not even close, it’s a total mismatch,” McCooe said. “A lot of big rounds are getting done and they’re out-of-state funders.” That risks, he said, opening the door for Connecticut-based companies that have developed technology here to move, similar to Alexion’s decision to relocate its New Haven headquarters to Boston.

“We want to make sure that doesn’t happen,” McCooe said.

The state needs more investors willing to participate in the angel networks, he said, encouraging individuals with means to lead the charge, with CI acting as the “invisible hand” behind the scenes. A healthy angel network is not led by the state, he said, but CI can lend support and tout its companies.

One thing McCooe has heard from angels is a concern about whether there are enough good companies in Connecticut in which to invest.

To counter that and show why the state is attractive for investors, McCooe in early May held an event in Stamford with the Angel Investor Forum and Crossroads Venture Group, introducing investors to the state’s most promising tech companies, five of which made pitches.

He also educated investors about Connecticut’s angel investor tax credit program, which CI administers.

“Earn a tax voucher for 25 percent of your angel investment dollars up to $1 million,” said the email inviting investors. “Cut your taxes and jump into the deep end of Connecticut’s innovation pool.

“The invitation to the event noted companies such as Datto, Biohaven and Blue Buffalo, all Connecticut-based startups, which sold or went public for more than $1 billion in recent years. Aside from the five pitch companies, executives and founders from seven other Connecticut companies also attended the event.

McCooe plans to hold a similar event in Hartford sometime in the future.

He also noted that lawmakers this year allocated $10 million for CI to invest in much-needed VC firms coming to or already in Connecticut and another $10 million to get more early stage companies up and running with so-called proof-of-concept funding for investments up to $100,000.

The awards, to come from CI and/or its subsidiary, CTNext, could be in the form of grants or loans, the latter to regenerate the funding for other investments, he said. Funding would be available for concepts emerging from university research, too.

Angels look for right fit

Joe DeMartino, managing director of the Angel Investor Forum in Connecticut and an active angel in the state, said AIF members prefer to invest in Connecticut companies because of the angel investor tax credit.If a company is a good investment, Connecticut-based and fits AIF’s investment profile (typically life sciences and technology companies that can grow quickly and from which AIF can exit in about four to six years), “that is an immediate advantage that they have because we’re all looking for that tax credit,” said DeMartino, who looks for two to three deals a year in the state, but also is active throughout the New York-to-Boston region.In fiscal 2017, angel investors parked about $7 million into Connecticut companies, according to data from the state Department of Economic and Community Development. Since the tax credit’s inception, angels have invested $60.1 million through 669 investments, DECD data shows.Companies also need to know what investors want and the kinds of businesses they invest in, what the funding process is and what the sources of funding are, DiMartino said. Some companies AIF might be interested in have never applied for funding and don’t know about AIF,”and conversely, we’ve never heard of them,” he said.”I think that there’s just not as robust an ecosystem for getting the word out and for entrepreneurs to understand the process and kind of where to go for these sources of funding,” he said.”I think bringing a cohesive ecosystem together with education for the entrepreneurs about how to go about this is really the important thing,” DeMartino added.DeMartino said Boston’s ecosystem is very robust, adding that entrepreneurs there know who to go to and where to go to look for funding, less so here.Connecticut companies are also located between two very big investment environments, New York and Boston, so AIF investors get pitched from companies there often, meaning Connecticut companies are essentially competing for AIF funding against those markets, he said.AIF, which has held steady at about 40 members for the past several years, evaluates applications, invites three companies per month to pitch, after which members can opt to advance to due diligence and potential investment, he said. Members invest individually. Groups like AIF generally bring $200,000 to $500,000 for a company they like, he said. A $250,000 AIF investment might include 10 angels at $25,000 each, for example.”We’ve done, collectively as a group, individual deals that are as high as $1.2 million,” he said and rounds in the $400,000-to-$600,000 range.Companies need to sell themselves, too, he said. Often, they have a build-it-and-they-will-come attitude, thinking investors will automatically flock to their idea or product.”It doesn’t work like that,” he said.Companies need to realize that getting investment, especially if they’re pre-revenue and don’t have a track record, is a sales process, he said.Upward Hartford’s Schlossberg agrees.”You have to hustle,” she said. “From our positions, we have to sell these companies like we’re selling shoes in a store.”

Another perspective

David O’Leary, an angel investor who moved to Springfield, Mass., from Maryland, outside Washington, D.C., less than a year ago, is still learning Connecticut, but attended reSET’s Venture Showcase on May 10 featuring eight companies that went through reSET’s accelerator program. As a member of the national Investors’ Circle — which bills itself as the world’s largest and most active early stage impact investing network that has helped entrepreneurs focused on improving the environment, education, health and community — O’Leary has a personal interest in clean energy.He saw a couple companies at the showcase that he planned to introduce to other potential customers or investors. While most angels tend to invest locally, there’s more syndication today of groups working together on deals and it’s easier for entrepreneurs to make their initial pitch with more distant potential funders through technology like video conferencing, he said.O’Leary said having a group of angel investors working together to support an entrepreneur or an entrepreneurial ecosystem works better than several people working independently from each other.He also sees room for getting more women involved in early stage investing.There are plenty of “old, rich white guys” investing in computer science entrepreneurs out of Harvard, MIT and Stanford, and “while that part is working, the rest isn’t working too well and as a result you’re kind of missing big chunks of the market,” O’Leary said. He noted a group of women in Massachusetts’ Pioneer Valley forming a VC fund that intends to look for investments in the Connecticut River Valley, he said.While other parts of the country have higher concentrations of investors and well-developed ecosystems, the Hartford region has diverse entrepreneurs and myriad pieces to the ecosystem, including UConn and accelerators, he said.”You’re not out in the middle of nowhere, there’s certainly a lot of wealth in the state of Connecticut,” O’Leary said. “So what’s the catalyst that brings us all of those pieces together is still maybe a question mark, but it feels like we’re getting closer.”